Global Tomato Paste Market Outlook 2025

Overview: Global Production, Supply, and Demand

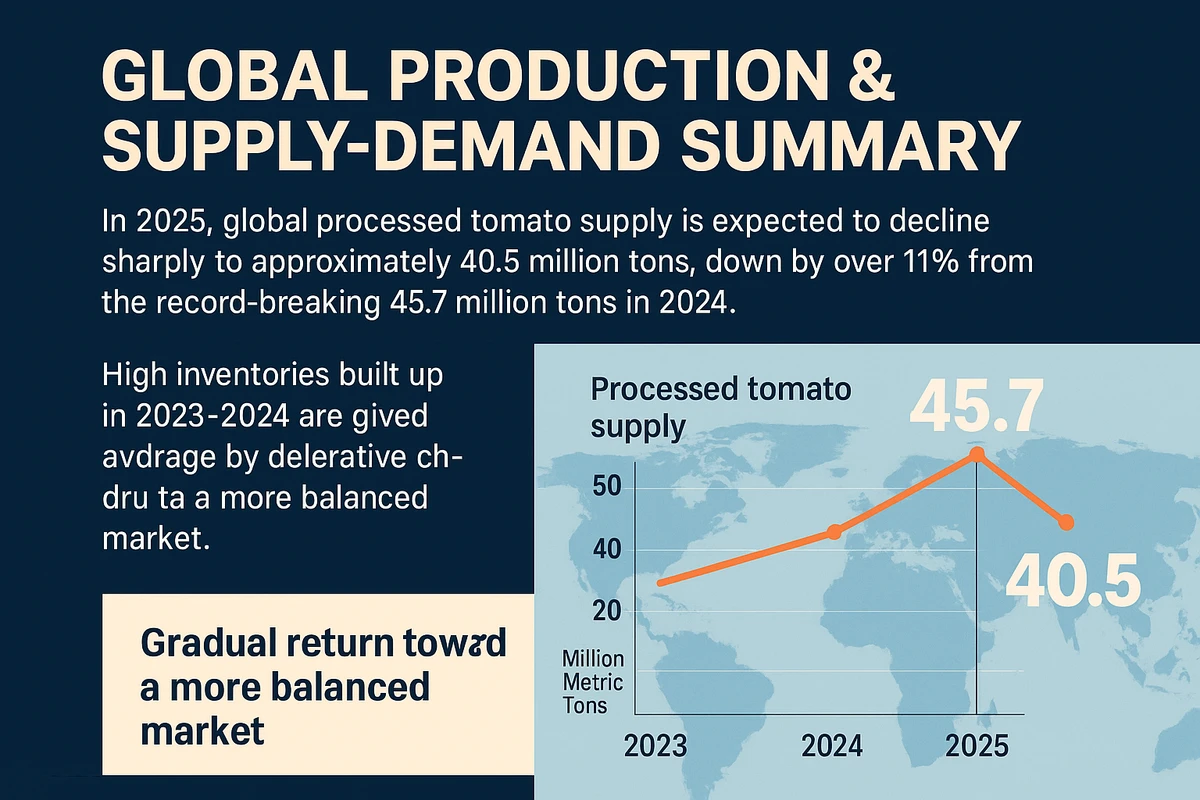

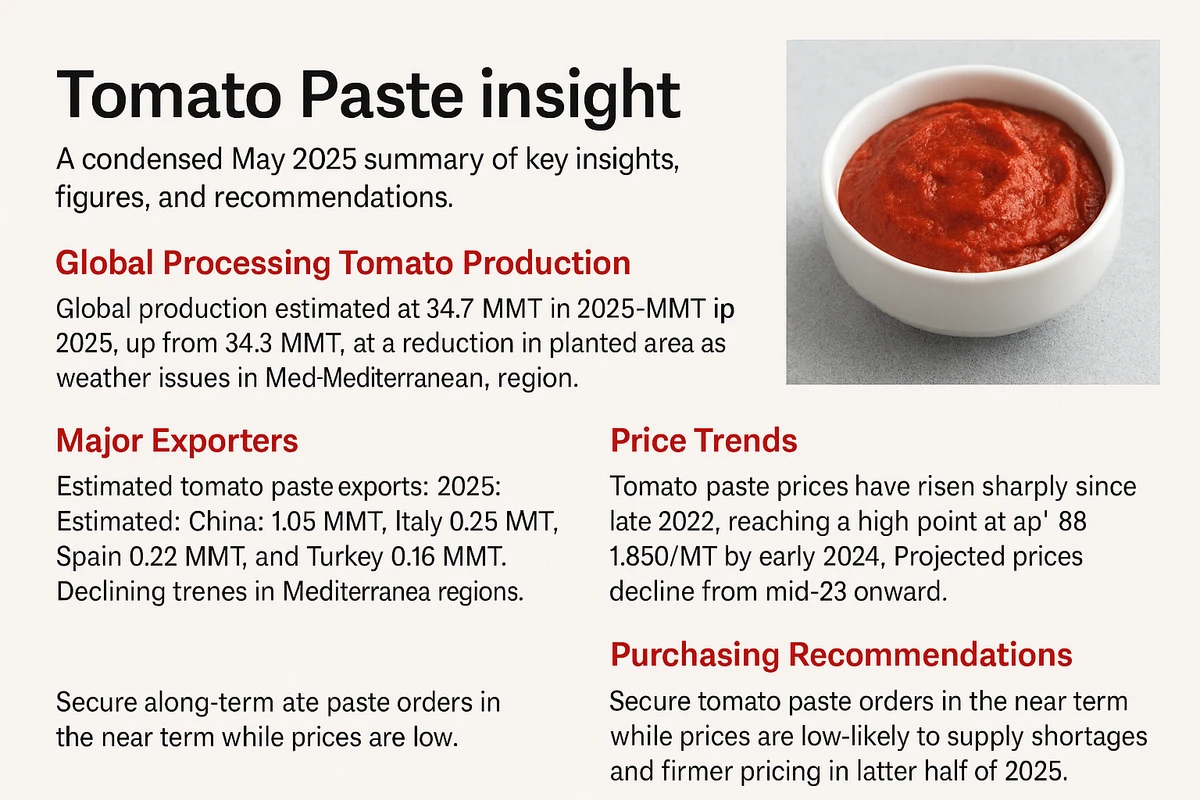

The global tomato paste market is poised for a pivotal year in 2025. After two years of record-breaking output, global processed tomato production is projected to drop significantly to approximately 40.5 million metric tons, marking an 11% decline from the all-time high of 45.7 million tons in 2024. This production cut is mainly driven by strategic reductions in major producing regions—particularly China and California—in response to the market oversupply experienced in 2024 and the resulting drop in farm-gate prices.

Despite this sharp decline in new production, global inventory levels remain high, especially in the United States and Europe, due to stockpiling during the 2023–2024 period. These existing reserves are helping to keep overall supply stable and preventing major shortages. As the market shifts away from oversaturation, the industry is entering a rebalancing phase characterized by improving alignment between supply and demand.

Demand for tomato paste and its derivative products is growing steadily at 2–3% annually, bolstered by both emerging markets and food service sectors in developed countries. For 2025, buyers can expect improved predictability in supply chains, more manageable pricing, and reduced volatility, provided no severe weather or policy shocks occur.

2025 Outlook for Key Exporting Countries

China

2025 forecasted production: 6 million metric tons

2024 production: 10.5 million tons (historic high)

Exports (2024): ~1.2 million tons

Export position: World’s largest tomato paste exporter

China’s tomato paste sector is expected to contract significantly in 2025, with output dropping by 42% year-on-year. This sharp reduction follows the excessive production levels of 2024, which created a global oversupply and led to a collapse in prices. These conditions discouraged many growers from planting in 2025.

While China's processing infrastructure remains robust, a significant number of factories are likely to remain idle due to reduced raw material availability. Despite the decline in output, China is expected to continue offering the most competitive FOB prices globally (around $900/ton for bulk), mainly due to large inventories and an aggressive push to clear them.

Early in the season, Chinese exporters are expected to prioritize inventory liquidation, which could result in short-term price competition. However, buyers should stay alert to potential logistics bottlenecks and policy-driven constraints.

Italy

2024 production: 5.25 million tons

2025 forecast: Slight reduction in contracted volumes

Export position: Second-largest exporter globally, dominant in premium/value-added segments

Italy’s 2024 production fell short of expectations due to flooding in the northern regions, although stable production in the south helped offset these losses. For 2025, a modest reduction in contracted volumes is expected, as processors adopt a more cautious stance.

Italy maintains its reputation as a premium supplier, particularly for customers in the European Union. Recent easing in energy and inflationary pressures has improved processor margins, while its geographic proximity to core EU markets provides a significant logistics advantage. While Italian products tend to be priced higher than Chinese or Turkish paste, they are regarded as reliable and high quality, especially for value-added applications.

Spain

2024 production: 3.06 million tons

2025 forecast: 2.4 million tons

Export focus: EU, Middle East, Africa

Spain is deliberately scaling back its tomato paste production by around 600,000 tons in 2025, following a high-yield season in 2024, particularly in Extremadura. This proactive reduction is aimed at preventing a repeat of the oversupply scenario seen across global markets.

Spain remains a strategic supplier to European, African, and Middle Eastern buyers. Its mid-tier pricing, coupled with shorter transit times and a solid reputation, makes Spanish tomato paste a dependable choice. Nevertheless, high irrigation costs and climate-related risks—such as potential droughts—could influence both pricing and output in the coming years.

Turkey

2024 production: 2.7 million tons

2025 outlook: Stable or slightly reduced

Exports (2024): 177,000 tons (up 4% YoY)

Turkey has maintained consistent tomato paste production and has seen a modest increase in exports. The country benefits from a favorable exchange rate, government support, and competitive pricing, which have helped it expand its presence in the MENA region, Europe, and parts of Asia.

However, low Brix levels in the 2024 crop raised the cost per ton of processed paste, reducing processor margins. Additionally, buyers should closely monitor Turkish policy developments, including potential export controls, which could impact availability.

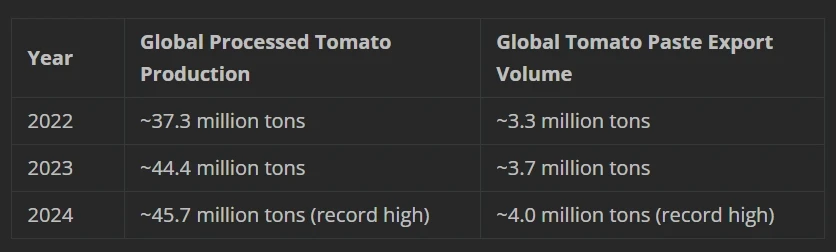

Global Production and Trade Trends (2022–2024)

2022: Severe droughts and weather-related disruptions led to tight global supplies and record-high prices.

2023–2024: A strong rebound in production across multiple regions resulted in significant oversupply and the buildup of global inventories.

2025: The industry is transitioning into a rebalancing cycle, with key producers curbing output to stabilize the market and restore sustainable margins.

Price Evolution and 2025 Forecast

Recent Price Trends:

2022–2023: Spot prices surged across the board due to limited supply. Bulk tomato paste FOB prices reached $1,800–$2,200/ton in some cases.

2024: Oversupply caused prices to fall sharply:

China: ~$900/ton FOB (bulk)

Europe: €1,100–€1,200/ton

USA: $1,200–$1,300/ton

2025 Outlook:

Prices are expected to stabilize or rise slightly, as global production declines but existing inventories help meet demand.

Potential risks to price stability include:

Extreme weather events in California, Xinjiang, or Southern Europe

Freight cost fluctuations

Geopolitical or trade policy shifts (e.g., the 25% U.S. tariff on Chinese paste)

In summary, 2025 should see a more predictable pricing environment, but volatility remains a possibility, particularly if weather conditions disrupt the Northern Hemisphere crop cycle.

Strategic Procurement Recommendations for Buyers

To navigate the evolving tomato paste market in 2025, buyers should adopt a balanced, forward-looking procurement strategy:

1. Diversify Your Supplier Base

Combine cost-effective suppliers (China, Turkey) with premium or regional alternatives (Italy, Spain).

Reduces dependency on any single geography and mitigates risks from weather, regulation, or transport disruptions.

2. Use Forward Contracts Wisely

Lock in 50–70% of your annual volume using forward agreements at current prices.

Retain the remaining capacity for opportunistic purchases on the spot market, should prices drop or special deals arise.

3. Maintain a Lean Safety Stock

Avoid excess inventory in 2025, as interest rates and storage costs remain high.

Keep a 2–3 month supply buffer and rotate stock to minimize waste and quality degradation.

4. Closely Monitor Key Market Indicators

Track weather patterns in production zones like California, Italy, and Xinjiang.

Follow updates from sources such as the WPTC, USDA, and major market analysts.

Monitor freight rate trends, tariff developments, and currency exchange shifts, especially in Turkey and China.

5. Engage Early and Proactively with Suppliers

Build strong relationships to secure flexible terms such as volume add-ons or staggered deliveries.

Explore non-traditional sources (e.g., Portugal, Greece) that may offer additional agility and responsiveness.

Conclusion

The global tomato paste market in 2025 is undergoing a much-needed recalibration after years of extremes—from shortages to oversupply. With production volumes down but inventories still adequate, buyers find themselves in a unique position to optimize procurement strategies.

Prices are likely to remain reasonable and supply more predictable, presenting an opportunity to lock in favorable terms. By diversifying sourcing, using strategic contracting, and staying informed on market signals, international buyers can confidently navigate the evolving landscape and build resilient tomato paste supply chains for the year ahead.