China’s Canned Peach Exports: January to April 2025 Market Analysis

Introduction

China remains one of the world’s leading producers and exporters of canned peaches, supplying high-quality products to global markets. However, recent trade data indicates shifting trends in demand, pricing, and regional export performance. This report provides a comprehensive analysis of China’s canned peach exports from January to April 2025, examining key metrics such as export volume, value, pricing trends, major destination markets, and domestic production hubs.

The findings reveal a decline in both export volume and revenue compared to the previous year, signaling potential challenges such as increased competition, changing consumer preferences, or economic pressures in key importing countries. By dissecting these trends, stakeholders—including producers, exporters, and policymakers—can better understand market dynamics and strategize for future growth.

Export Overview: Declining Volumes and Revenues

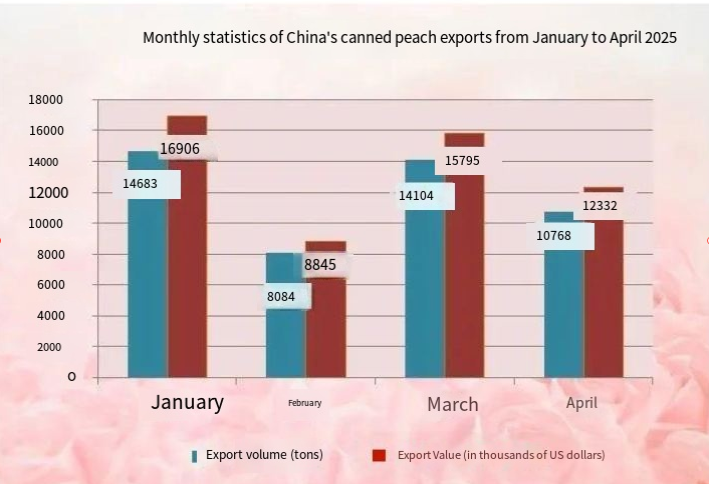

From January to April 2025, China exported 47,600 metric tons of canned peaches, generating $53.88 million in revenue, with an average unit price of $1,131 per ton. Compared to the same period in 2024, these figures reflect:

A 4% decline in export volume

A 14% drop in total export value

An 11% decrease in average price per ton

Monthly Performance: April 2025 Highlights

In April alone, exports amounted to 10,800 tons, worth $12.33 million, at an average price of $1,145 per ton. This represents:

An 11% year-on-year decline in volume

A 21% drop in export value

An 11% decrease in unit price

The consistent downward trend suggests weakening demand or increased competition from alternative suppliers, such as Spain, Greece, or South Africa, which may be offering more competitive pricing or diversified product offerings.

Key Export Markets: Shifts in Global Demand

China’s canned peaches reached 86 countries and regions in early 2025, with the following nations emerging as the top importers by value:

1. Japan: The Leading Market (24% Share)

Volume: 11,200 tons

Value: $14.82 million

Average Price: $1,323/ton

Year-on-Year Change:

Quantity: -1%

Value: -10%

Price: -8%

Japan remains China’s largest canned peach buyer, though demand has softened slightly. The price decline may reflect competitive pressure from domestic Japanese brands or other Asian exporters.

2. United States: Significant Decline (21% Share)

Volume: 9,902 tons

Value: $10.81 million

Average Price: $1,092/ton

Year-on-Year Change:

Quantity: -20%

Value: -31%

Price: -14%

The U.S. market experienced the sharpest drop, likely due to economic factors such as inflation reducing consumer spending on non-essential goods, or trade policies affecting import costs.

3. Thailand: Growth Amidst Decline (7% Share)

Volume: 3,333 tons (+27%)

Value: $3.69 million (+16%)

Average Price: $1,108/ton (-9%)

Thailand stands out as a growing market, possibly due to increased retail demand or trade agreements facilitating easier access.

4. Canada: Steady Increase (6% Share)

Volume: 2,892 tons (+17%)

Value: $3.61 million (+9%)

Average Price: $1,247/ton (-7%)

Canada’s growth suggests stable demand, though falling prices indicate competitive pricing strategies by Chinese exporters.

Other Notable Markets

Mexico, Chile, Vietnam, and Australia also featured among the top destinations, though detailed data shows mixed trends—some stabilizing, others declining.

Domestic Export Hubs: Regional Performance

China’s canned peach exports are dominated by a few key provinces, each contributing differently to the overall trade landscape:

1. Shandong Province (30% Share)

Volume: 14,400 tons (-15%)

Value: $17.12 million (-26%)

Average Price: $1,190/ton (-14%)

Shandong, a major agricultural hub, saw the steepest declines, possibly due to production challenges or reduced competitiveness in pricing.

2. Zhejiang Province (15% Share)

Volume: 7,037 tons (-4%)

Value: $9.19 million (-4%)

Average Price: $1,306/ton (stable)

Zhejiang maintained relatively stable pricing, suggesting strong product quality or brand reputation.

3. Anhui Province (18% Share)

Volume: 8,798 tons (+5%)

Value: $7.48 million (-9%)

Average Price: $850/ton (-13%)

Anhui increased its export volume but at lower prices, indicating a possible shift toward budget-oriented markets.

Other Contributing Regions

Jiangsu, Fujian, and Hebei also played roles in exports, though with varying degrees of growth or contraction.

Comparative Analysis: 2024 vs. 2025

In 2024, China’s canned peach exports from January to April showed:

Total Volume: 49,600 tons (+14% from 2023)

Total Value: $62.73 million (+9%)

Average Price: $1,266/ton (-4%)

The 2025 downturn suggests:

Market Saturation: Major buyers like the U.S. and Japan may be diversifying suppliers.

Price Sensitivity: Global inflation could be pushing buyers toward cheaper alternatives.

Supply Chain Adjustments: Some provinces (e.g., Anhui) are increasing output but at lower margins.

Conclusion and Future Outlook

China’s canned peach export sector faces challenges in 2025, with declining volumes, revenues, and prices across most key markets. However, growth in regions like Thailand and Canada indicates pockets of opportunity.

Strategic Recommendations:

Diversify Export Markets: Explore emerging economies in Southeast Asia, Africa, and the Middle East.

Enhance Product Value: Focus on premium branding or organic certifications to justify higher prices.

Optimize Production Costs: Provinces like Anhui could benefit from efficiency improvements to maintain profitability.

While the current trends suggest a contraction, strategic adjustments could help Chinese exporters regain momentum in the global canned fruit market.