China's Canned Orange Exports in the First Quarter of 2025: A Comprehensive Analysis

Introduction

China has long been a dominant player in the global canned fruit market, with canned oranges being one of its key export products. The first quarter of 2025 saw continued growth in this sector, with notable increases in export volume, value, and average prices. This report provides a detailed analysis of China’s canned orange exports during this period, covering export performance, key markets, regional contributions, and trends compared to previous years.

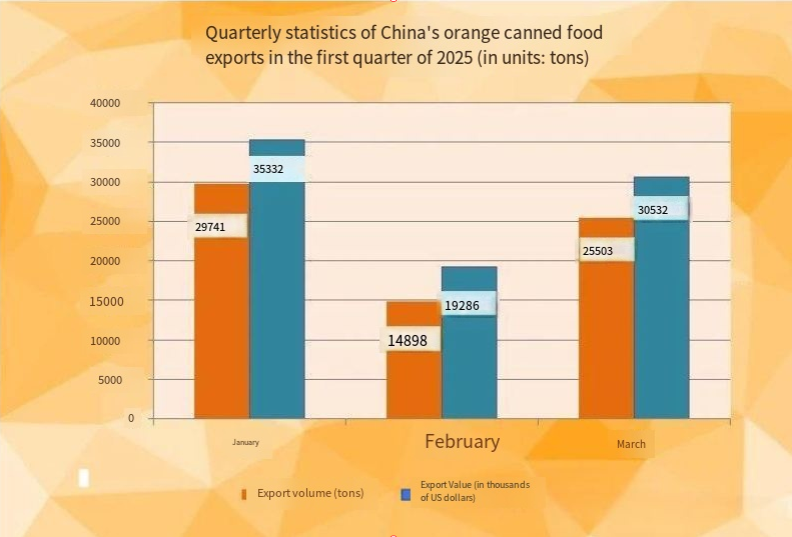

Export Overview

In the first quarter of 2025, China's canned orange exports totaled 70,100 tons, with a total value of US$85.15 million and an average unit price of US$1,214 per ton. Compared with the same period last year, the quantity increased by 8%, the value increased by 11%, and the average price increased by 3%.When compared to the same period in 2024:

Export volume increased by 8%

Export value rose by 11%

Average unit price grew by 3%

This consistent growth indicates strong international demand and China’s ability to maintain competitive pricing while improving product value.

Monthly Performance (March 2025)

Among them, in March 2024, China's canned orange exports were 25,500 tons, with a value of US$30.53 million and an average price of US$1,197 per ton. Compared with the same period last year, the quantity increased by 10%, the value increased by 13%, and the average price increased by 2%.

Export volume rose by 10%

Export value increased by 13%

Average price grew by 2%

This monthly surge suggests a seasonal uptick in demand, possibly due to restocking by international buyers ahead of peak consumption periods.

Leading Export Destinations

China exported canned oranges to 50 countries and regions in Q1 2025. The top eight markets by export value were:

1. United States

2. Japan

3. Germany

4. Canada

5. Indonesia

6. United Kingdom

7. Thailand

8. Netherlands

1. United States – The Largest Importer

Volume: 35,500 tons (51% of total exports)

Value: $45.14 million

Average Price: $1,271 per ton

Year-on-Year Growth (Q1 2024 vs. Q1 2025):

Volume: +24%

Value: +28%

Price: +3%

The U.S. remains China’s most critical market, with demand driven by retail chains, food service industries, and consumer preferences for affordable, high-quality canned fruits.

2. Japan – Steady Demand with Slight Price Decline

Volume: 15,300 tons (22% of total exports)

Value: $18.07 million

Average Price: $1,177 per ton

Year-on-Year Growth:

Volume: +8%

Value: +5%

Price: -3%

Japan’s demand remains stable, though the slight price drop may reflect competitive pricing strategies or shifts in import preferences.

3. Germany – Rapid Growth in Volume

Volume: 3,889 tons (6% of total exports)

Value: $4.51 million

Average Price: $1,160 per ton

Year-on-Year Growth:

Volume: +79%

Value: +73%

Price: -3%

Germany’s dramatic import surge suggests new trade agreements, increased retail demand, or supply chain adjustments favoring Chinese canned oranges.

Other Key Markets

Canada, Indonesia, and the UK maintained steady imports, with moderate growth in volume and value.

Thailand and the Netherlands showed promising demand, indicating expanding market penetration in Southeast Asia and Europe.

Exporting Provinces and Cities in China

In Q1 2025, 18 Chinese provinces and cities contributed to canned orange exports. The top six exporting regions by value were:

Zhejiang Province

Hubei Province

Shandong Province

Anhui Province

Hunan Province

Jiangsu Province

1. Zhejiang Province – The Leading Exporter

Volume: 44,900 tons (64% of total exports)

Value: $57.23 million

Average Price: $1,276 per ton

Year-on-Year Growth:

Volume: +12%

Value: +16%

Price: +4%

Zhejiang’s dominance is attributed to its advanced food processing infrastructure, efficient logistics, and strong international trade networks.

2. Hubei Province – Declining Exports

Volume: 10,800 tons (15% of total exports)

Value: $10.14 million

Average Price: $941 per ton

Year-on-Year Growth:

Volume: -16%

Value: -19%

Price: -3%

Hubei’s decline may be due to production challenges, competition from other provinces, or shifts in global demand for its specific product offerings.

3. Shandong Province – Strong Growth

Volume: 5,792 tons (8% of total exports)

Value: $6.75 million

Average Price: $1,165 per ton

Year-on-Year Growth:

Volume: +21%

Value: +23%

Price: +2%

Shandong’s growth highlights its rising importance in China’s canned fruit export sector, likely due to investments in processing technology and export-oriented production.

Other Contributing Regions

Anhui, Hunan, and Jiangsu showed stable export contributions, with minor fluctuations in volume and pricing.

Market Trends and Analysis

1. Rising Global Demand for Convenience Foods

The growth in canned orange exports aligns with the global trend toward convenience foods, particularly in Western markets where canned fruits are widely used in desserts, beverages, and quick meals.

2. Competitive Pricing Strategies

China’s ability to maintain moderate price increases (3% YoY) while expanding market share demonstrates its cost-efficiency in production and export logistics.

3. Diversification of Export Markets

While the U.S. and Japan remain top buyers, the rapid growth in Germany, Thailand, and the Netherlands suggests successful market diversification efforts.

4. Regional Production Dynamics

Zhejiang’s continued dominance underscores its role as China’s canned fruit export hub.

Hubei’s decline may prompt local industries to reassess production strategies to regain competitiveness.

Shandong’s expansion indicates a shifting landscape in China’s food processing sector.

Challenges and Opportunities

Challenges:

Price Sensitivity: Some markets (e.g., Japan, Germany) saw slight price declines, indicating competitive pressures.

(1) Regional Volatility: Hubei’s export drop highlights the need for resilience in production and supply chains.

(2) Trade Policies: Potential tariffs or import restrictions in key markets could impact future growth.

Opportunities:

(1) Expanding into Emerging Markets: Southeast Asia, the Middle East, and Africa present untapped potential.

(2) Value-Added Products: Introducing organic, low-sugar, or premium canned oranges could attract higher-paying consumers.

Technological Investments: Automation and AI in production could further reduce costs and improve quality.

Conclusion

China’s canned orange exports in Q1 2025 demonstrated strong growth, with increases in volume, value, and average prices. The United States remained the largest importer, while Zhejiang Province led domestic exports. Despite some regional declines, the overall outlook remains positive, driven by rising global demand and China’s competitive production capabilities.

Moving forward, diversifying export markets, enhancing product quality, and adapting to trade dynamics will be crucial for sustaining this growth trajectory. With strategic investments and market adaptation, China is well-positioned to reinforce its leadership in the global canned orange trade.